The potential imposition of significant U.S. tariffs starting April 2, 2025, indicates economic uncertainty, leading to a substantial rise in the price of goods for consumers and businesses. This significantly impacts domestic manufacturers and international companies facing disrupted supply chains and increased import costs.

To cushion the domestic market against the tariff war, the US Federal Reserve has maintained higher interest rates. However, this dampens economic activity and raises potential fears of a global slowdown, fracturing international commerce and fueling trade wars across regions. This raises concerns for businesses, investors, and policymakers worldwide.

How Trump’s Tariffs Are Sparking Chances of US Recession

The fear of the US recession is continuously growing, and several factors are responsible for this, which are mentioned below.

Monitoring Policy Tightening—

The US Federal Reserve held a meeting in 2025 and decided to keep the interest rate steady at 4.5% but highlighted projections for slower growth and higher inflation, partly due to higher Trump tariffs.

Impact of Tariffs and Trade Dispute—

The imposition of heavier US tariffs on foreign goods causes businesses to pay more for their import needs, and companies are passing these costs on to consumers, which may significantly contribute to inflation.

Declining Economic Indicators –

- A slight decline in retail sales was observed in January 2025, highlighting the weakening of consumer demand.

- The US GDP growth rate has shown a declining trend, projecting a drop in the GDP for the first quarter in 2025.

Rising level of national debt is becoming a serious concern that may cause decrease in private sector participation, and making that crippling economy more vulnerable.

Chances of US Recession: A Setback for American Goods Exports to the World

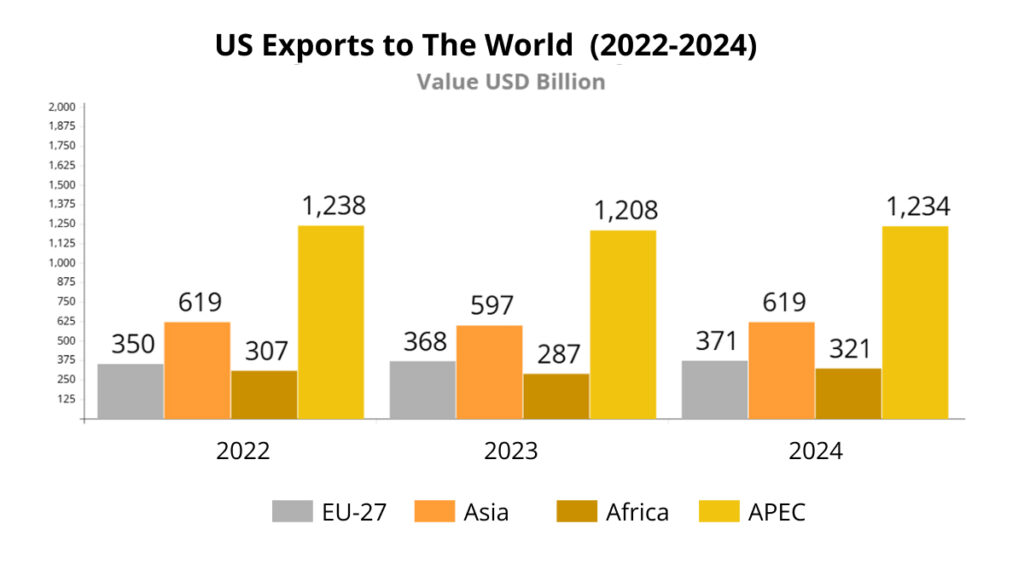

If the US economy experiences a recession and continues with reciprocal tariffs, then exports to top destinations such as the EU, Asia, Africa, and APEC may witness a decline in imports from the US, and a shrinking export market with rising inflation pushes the US economy under a long-term recession. In this, the US exporters may lose a trillion dollars market.

- Notably, US exports to the EU and Africa have slightly increased by 6% and 4.5% in 2024 compared to 2022.

- US trade with Asia and APEC increased in 2024 compared to 2023. However, compared to 2022, the export value has decreased or remained stagnant.

- US trade with all significant continents may decrease if policies are not taken effectively.

| Year | EU-27 | Asia | Africa | APEC |

| 2022 | 350 | 619 | 307 | 1238 |

| 2023 | 368 | 597 | 287 | 1208 |

| 2024 | 371 | 619 | 321 | 1234 |

**Value USD Billion

What Will be the Impact of US Recession on Import Market

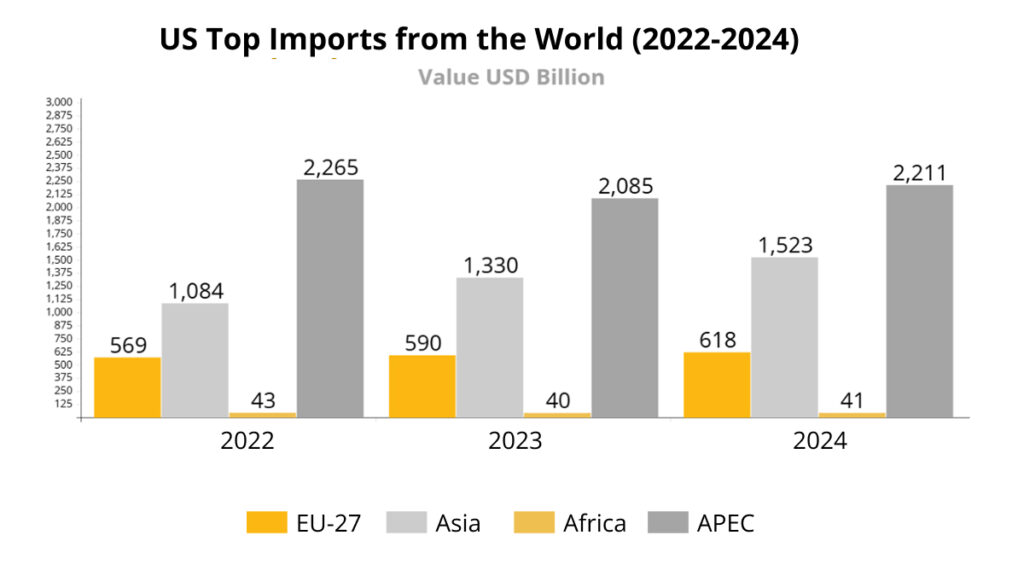

Under the trump administration, the US imposed reciprocal tariffs on foreign goods. This makes foreign-supplied goods costly, making US consumers pay more for the same commodities they bought cheaply earlier. The higher price in the local market and the costly import may increase the chances of a US recession. Here’s a quick view of the US’s top imports –

- Asia and APEC are the largest suppliers to the US, with $1523 and $221 billion exports in 2024.

- In 2024, the EU and Africa exported goods worth $618 billion & $41 billion to the US.

- The potential imposition of tariffs on all foreign goods from 2nd April 2025 may force suppliers to find an alternative market for their goods supplies.

- Further, the burden of tariffs will be directly faced by the consumer market, and inflated goods prices will increase the chance of a US recession.

- However, the retaliatory tariffs may disrupt the supply chain and lead to a global slowdown.

| Years | EU-27 | Asia | Africa | APEC |

| 2022 | 569 | 1084 | 43 | 2265 |

| 2023 | 590 | 1330 | 40 | 2085 |

| 2024 | 618 | 1523 | 41 | 2211 |

Value USD Billion***

US Tariffs: An Impact on Countries Supplying Goods to the US

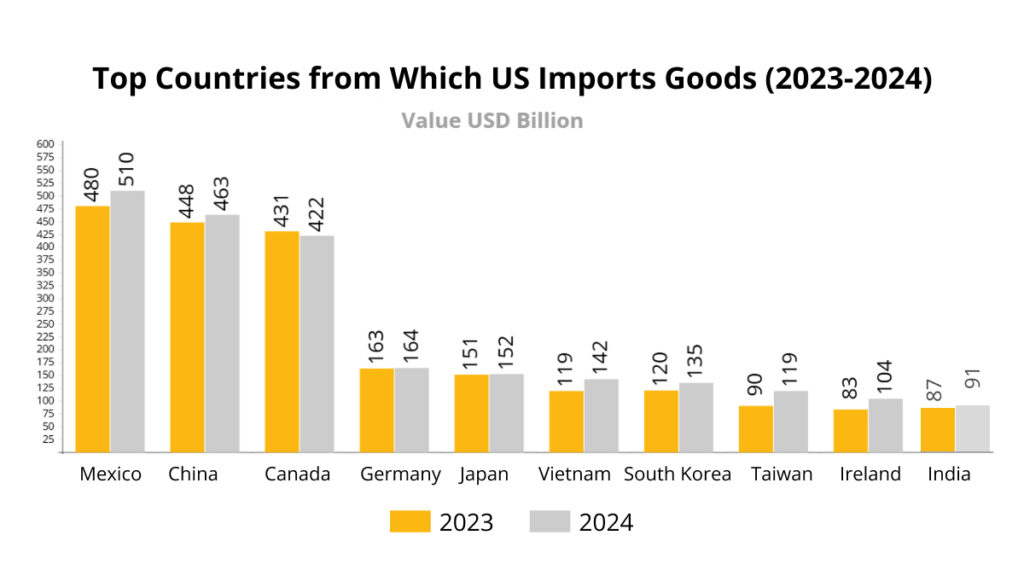

Tariffs on imported goods increase goods’ prices for American buyers and potentially reduce the demand for exports from the supply countries. It forces suppliers to lower their goods’ prices and profit margins to remain competitive. Here’s are the list of top exporters to the US which may lose market share in the future –

- Mexico, China, Canada, Germany, and Japan were the top suppliers of goods to the US in 2024 and experienced a significant surge in their export value.

- Mexico and China’s exports to the US surged by $30 billion and $15 billion in 2024, while Canada’s exports fell by $9 billion.

- Tariffs will drastically affect the overall export value, shrink the top importers’ market, and negatively affect their revenue.

- For instance, due to a rise in tariffs, Canadian agribusinesses have strengthened their agricultural export to Indonesia.

- This may encourage other countries to establish or strengthen trade ties with emerging countries for sustainable growth.

| Countries | Imports In 2023 (USD Billion) | Imports In 2024 (USD Billion) |

| Mexico | 480 | 510 |

| China | 448 | 463 |

| Canada | 431 | 422 |

| Germany | 163 | 164 |

| Japan | 151 | 152 |

| Vietnam | 119 | 142 |

| South Korea | 120 | 135 |

| Taiwan | 90 | 119 |

| Ireland | 83 | 104 |

| India | 87 | 91 |

US Tariffs: Self-Destructive in Nature for Igniting Recession

US Tariffs on foreign goods could be self-destructive for the US economy, potentially igniting a recession through several interconnected mechanisms. For instance –

- Tariffs may cause higher production costs for domestic manufacturers.

- It can stifle consumer spending, a major driver of economic growth.

- Finally, tariffs will create a ripple effect, resulting in trade uncertainty and economic slowdown.

- Tariffs may trigger retaliatory measures, leading to higher costs for US exporters, impacting businesses and jobs.

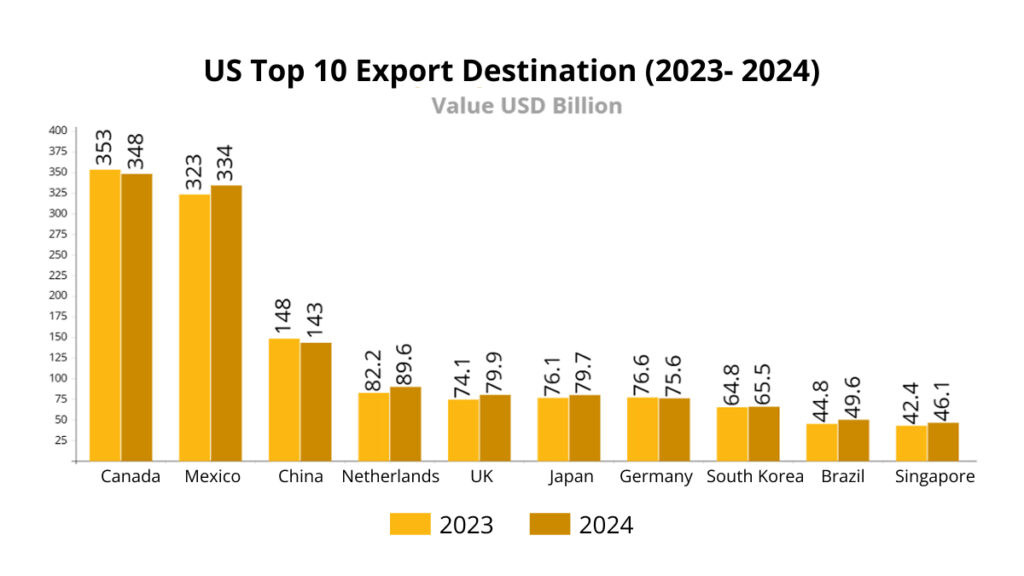

- With the rise in retaliatory tariff measures, for instance, China imposed tariffs on US goods, hurting US exporters. Here’s the list of the top 10 US export destinations –

Top 10 US export destinations

- Canada, Mexico, China, the Netherlands, and the UK are the top destination countries for US exports in 2024.

- Notably, Canada and China have witnessed a slight downward trend in US import goods, indicating trade conflicts and disputes.

| Countries | Exports In 2023 (USD Billion) | Exports In 2024 (USD Billion) |

| Canada | 353 | 348 |

| Mexico | 323 | 334 |

| China | 148 | 143 |

| Netherlands | 82.2 | 89.6 |

| UK | 74.1 | 79.9 |

| Japan | 76.1 | 79.7 |

| Germany | 76.6 | 75.6 |

| South Korea | 64.8 | 65.5 |

| Brazil | 44.8 | 49.6 |

| Singapore | 42.4 | 46.1 |

Conclusion –

Trump’s new trade tariff policy in 2025 presents a severe domestic and global economic challenge. At the same time, it increases the chances of pushing the US economy into recession. Hence, it becomes crucial for the Trump administration to impose tariffs in a structured way while maintaining the negative growth rate. Further, foreign suppliers must work on fair trade policies where US exporters may access the international market.